Note: This blog post is information that is directed towards those individuals who have assets in BC and Ontario, but may be of interest to others as well.

If you are over 65 years of age, an Alter Ego Trust or a Joint Spousal Trust can be used to assist with your Estate Tax Plans and to help minimize the taxes due on your death as well as assisting in avoiding Probate Fees. Probate fees in BC are 1.4% of the Fair Market Value of the assets in a person’s estate. But like anything, there are advantages and disadvantages of creating one of these trusts.

Advantages:

These trusts can save your estate money when you die.

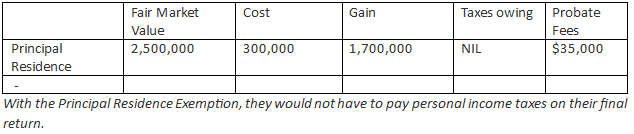

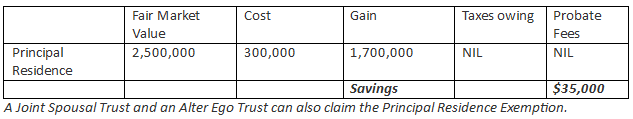

Asset Held Personally

Assets held in a Trust

Total cash savings when assets are in the trust is $35,000.

Ideally, we feel that this is a good option if your principal residence is worth more than $2.5 Million dollars. The savings on probate fees will outweigh the administration costs of maintaining the trust year to year.

There are other assets that could also be put into these trusts, but we would need to review this on an asset by asset basis.

These trusts will also allow you to live as you normally would. You can stay in your home and you still receive income from the assets that are placed in these trusts.

Some additional non-financial reasons why you might consider using a joint spousal trust or an alter ego trust in your estate planning is for privacy or in the instances of blended families. Assets in these trusts are not subject to public probate records nor can they be contested by beneficiaries. These trusts are also useful where there are adult children and the parent remarries and wants to ensure the new spouse can enjoy use of the family home and other assets until the spouse’s passing, after the spouses’ passing the assets can be distributed to children.

Disadvantages:

The biggest disadvantage of creating these trusts are the tax rates that these trusts pay on the undistributed income earned during a tax year. Trust income is taxed at the highest marginal tax rate for individuals, based on where the trust is located. In Alberta the top marginal tax rate is 48.%; in BC, it is 53.50%; and in Ontario, it is 53.53%.

The trusts can usually avoid paying tax at these rates by distributing their income out to the beneficiaries of the trust during the year.

An additional disadvantage is the cost to maintain the trust every year, by filing additional tax returns and paying any trustee or other administration fees. The trust is effectively a separate legal entity that must be maintained separate from your personal affairs.

The last disadvantage that we wanted to mention in this blog, is the differences that occurs when you die and your assets have been held personally, compared to when you die and your assets are held in a Trust.

When you die with a regular will, there is a deemed disposition of all your financial assets at their fair market values on that date. The gains and losses on these assets are realized on your final personal tax return and are automatically acquired by your Estate at those fair market values. The Estate is then administered by your executor/executrix as outlined in your will. From a tax perspective, your Estate is eligible to be treated as a Graduated Rate Estate and is taxed as an individual would be however, without the benefit of any personal tax credits. This means that the estate would be taxed on the same graduated tax rate schedule as an individual. This only lasts for 3 years and after the first 36 months, the tax rate defaults to the highest marginal rates.

Conversely, if you die and your assets are in a Joint Spousal Trust or an Alter Ego Trust, the assets in these Trusts are not eligible for these same graduated rates. Upon death, the assets in the Joint Spousal Trust or Alter Ego Trust will be taxed at the highest marginal tax rate; the assets will then be distributed from this Trust in accordance with the instructions in the trust indenture. The Joint Spousal Trust and Alter Ego Trust assets are held separate from the estate so the Trust assets will bypass any application of the last will and testament of these assets. It is therefore very important that the Trust Indenture and the Last Will and Testament be updated at the same time to ensure there is no conflict between these two very important legal documents.

This is a very simplified summary of some of the advantages and disadvantages that a Trust can provide to taxpayers and our belief is that, while there are some disadvantages to having a Joint Spousal Trust or an Alter Ego Trust, the cash tax savings should not be ignored. And many of the potential disadvantages just need to be analyzed to ensure that the cash tax savings still exists. If this is something that is of interest to you, please feel free to reach out to us to discuss further.