The Benefits of Financial Internal Controls in a Small Business

Cash is King/Queen in a small business. In an owner-managed business, working “on” the business vs. “in” the business is hard to do. You are so concerned with increasing revenues and keeping costs at a manageable level, that sometimes other operational areas are put on the “to do” list for a later day. However, having some financial controls in place is a good idea. The main purpose of these controls or procedures is to ensure that the cash earned in the business is protected. It also ensures accuracy in financial reporting and minimizes the risk of fraud or error. For small businesses, where resources are often tight, effective internal controls can mean the difference between survival and failure.

Here are some benefits of implementing financial internal controls in a small business:

Protection Against Fraud

One of the primary purposes of internal controls is to reduce the risk of fraud. Fraud can take many forms, from employees misappropriating funds to unauthorized purchases made on company credit cards. Small businesses, especially those with fewer employees, are often more vulnerable to fraudulent activities because a single person may have too much access over critical functions, like bookkeeping and financial reporting.

By implementing separation of duties—one of the cornerstones of internal controls—a business ensures that no single employee has complete control over any financial process. For instance, the employee who receives cash at the cash register during the day should not be the same person that reconciles the daily cash to sales at the end of the day.

Improved Accuracy in Financial Reporting

Accurate financial reporting is essential for informed decision-making. Internal controls such as regular account reconciliations, proper documentation of expenses, and reviews of financial statements ensure that the information on which you base your business decisions is reliable.

Having accurate records not only helps you understand your cash flow and profitability but also provides you with credible data when seeking loans or investors. Financial accuracy also ensures compliance with tax laws, reducing the risk of costly penalties and audits. An example of a control, would be to perform monthly bank reconciliations on all bank and credit card accounts. This ensures that transactions are recorded accurately and completely in your books and records. This exercise would also allow the person reconciling the account to identify any significant or unusual transactions that do not look appropriate.

Operational Efficiency

Effective internal controls contribute to operational efficiency by streamlining financial processes. When procedures are clearly defined and automated where possible, employees can perform their tasks more quickly and accurately. For example, having a well-documented purchase approval process can reduce delays in procuring materials or services, keeping projects on track. In a small business, this could be that the person who is placing the order needs to have approval from the business owner before finalizing the order. This approval could be done with an e-signature, or even an email. Approval by text is not as effective since it’s hard to refer back to it if there is a question as to whether or not approval has been given.

Additionally, automation tools like accounting software can enforce internal controls by requiring certain steps to be completed before moving forward, ensuring compliance and reducing human error.

Enhanced Accountability

Internal controls promote accountability among employees. When everyone in the organization understands the procedures and is held to a high standard, there is less room for mistakes, negligence, or misconduct. Clear, documented processes make it easy to track who is responsible for each financial transaction, reducing the likelihood of disputes and finger-pointing when things go wrong.

In small businesses, this is particularly important because owners often have a close working relationship with their staff. Transparent accountability helps maintain trust and ensures that any financial discrepancies are identified and addressed promptly. An example of this would be to have the internal controls documented in an employee handbook or a procedure manual that all employees have read.

Other reasons to have internal controls

Lenders and external investors: If they understand that your business already implements financial internal controls, they will have more confidence in you as a business owner. They understand that you understand the importance of safeguarding your company’s funds.

Tax Audits: Overall, tax auditors don’t care whether or not your business has any financial controls in place. However, when there is a request for information from a tax auditor, having financial controls in place will help you find the information you are looking for in a more efficient manner. And as a result, will allow you to have the tax auditor finish their work more quickly. It also gives them confidence that you are a fiscally responsible business owner.

Conclusion

In the fast-paced world of small business, it’s easy to prioritize growth and customer acquisition over back-end processes like financial controls. However, without effective internal controls, your business is vulnerable to fraud, errors, and inefficiencies that could derail your success. By investing in financial internal controls early, you protect your assets, ensure accurate reporting, and set your business up for sustainable growth.

Internal controls are not just for big corporations; they are a vital tool for small businesses to maintain financial health and thrive in a competitive market.

Please reach out to us at [email protected] if you would like us to talk to you about your company’s internal controls.

The Benefits of Financial Internal Controls in a Small Business Read More »

Things to Consider When Picking a Corporate Tax Year-end

When you create a company, you have the opportunity to determine when you would like the fiscal period to end. The general default for a person is to select December 31st as the year-end.

However, there are some other factors that you should consider when selecting a year-end date.

You have 365 days from the date of incorporation to select your year-end. And it is set once you file your first corporate tax return. But you can pick any day within that 365 day period to be your year-end.

One factor may be based on how your revenues are earned during a year. Ideally, you should be targeting your year-end to coincide with the end of a busy period where there is a bit of “calm”. This will allow you to gather up all of the paperwork for the year and to have the time to reflect on the activities in the year to make sure that everything has been captured.

You don’t want to have a drawn out year-end close process. Our memories can sometimes deceive us and the longer period of time between when you close a fiscal year for your company and when the actual fiscal year-end occurs, facts can be forgotten. Therefore, it is important to close off the books and records as soon as possible. This will also help you plan better for the upcoming year.

Some questions for you to consider:

- Is your business seasonal?

- For example: Is you business busiest during a school year? (September – June)

- Are the defined cycles to your business?

- Busy Spring & Summer, but slow Fall & Winter?

- Is your business tied to a government payment schedule or a government grant where you need to provide reporting to them based on their fiscal year-end?

- Most governments have a March year-end

- Is your busiest time of business in December?

If you are a retail based business or a restaurant, the industry standard is to have a January or February year-end. This allows your business to have the time to incorporate your most profitable periods into your business.

If your business earns most of its revenue supporting school-aged children during the in-session periods, then maybe a June/July year-end is best for you.

But what is a good year-end if your business is fairly consistent month over month, or there isn’t any consistency to revenues? Then you may opt for a month that suits your lifestyle. If you like to go away in January, maybe select a year-end that isn’t December or January. If you like to have your summers off, my suggestion would be to avoid the months from May – July as your fiscal year-end.

An additional point to consider when picking a fiscal year-end is a potential tax planning opportunity. If your business has an unusual year where there is higher than normal revenues, you have the opportunity to spread out how to withdraw that money for your personal purposes over more than one year.

So before you pick December 31st as your fiscal year-end, make sure you take the time to look at your business plan to see if there is another month that would be preferable. Taxes and accounting are hard enough to keep on top of when you are running your own business. So be kind to yourself and make sure that you are selecting the year-end that works best for you.

If you’d like to brainstorm this with someone, please feel free to reach out to us at [email protected].

Things to Consider When Picking a Corporate Tax Year-end Read More »

Tax Benefits of Purchasing Life Insurance through your Corporation

Life Insurance is a great thing to have. Especially from a tax perspective. When you personally purchase a life insurance policy, and you die, your beneficiaries receive the amount of the policy and it is a tax-free receipt of cash to them.

Certain policies purchased provide beneficiaries with sufficient cash to fund tax liabilities that you may leave behind in your estate (if your estate doesn’t have enough liquid cash to pay for the tax). This way, the family home doesn’t have to be sold just because you’ve passed away.

Life insurance can also be purchased by a company. If you own your own business, having your company purchase life insurance may be an advantageous tax planning strategy. The benefits of the company purchasing the life insurance on your behalf is that the premiums are paid with the company’s money and not your personal money, which makes it less expensive for you since it is being paid with pre-tax dollars, although an add back for the premiums is typically required when calculating taxable income. The proceeds of the life insurance could be received by the company on a tax-free basis and may be distributed to your beneficiaries on a tax-free basis through the corporation’s Capital Dividend Account. The proceeds may also be used to pay for any existing liabilities in the company that need to be settled subsequent to death.

There may be some other benefits as well, depending on the type of life insurance policy as this is a discussion that would be best to have with an Insurance Specialist.

If you have any questions, please reach out to us at [email protected].

Tax Benefits of Purchasing Life Insurance through your Corporation Read More »

Changes to how Rental Properties will be Taxed

In the Fall Economic Update statement (November 2023), it was stated that certain deductions were no longer going to be allowed after January 1, 2024. These rules became law on June 20, 2024 under Bill C-59. The legislation denies many expenses if you are not following the rules…

For the purposes of the Income Tax Act, rental properties located in an area where short-term rentals are not allowed are defined as “non-compliant short-term rental” properties. The definition of a short-term rental is for a property to be rented for a period of less than 90 consecutive days.

The portion of the expense that will not be deductible, is based on a formula.

Total of ALL EXPENSES incurred x # of days in the taxation year that the property was a non-compliant property / the number of days in the taxation year that the property was a short-term rental.

Generally, the following expenses would be allowed:

- Advertising expenses

- Insurance premiums

- Office expenses

- This would include pens, paper and other stationery types of items

- Legal expenses

- Legal services used to collect outstanding rent payments

- Fees to purchase a property are NOT an allowed deduction

- Accounting fees

- Bookkeeping services

- Preparation of the rental statement for your tax return

- Property management fees paid to an external party

- This includes strata fees

- Repairs and maintenance

- Your own labour costs are NOT an allowed deduction

- Wages of the person you pay to maintain your own property

- Don’t forget that you should be making withholding tax payments and submitting a T4Summary for these wages.

- Property taxes

- Travel expenses to get to your property

- Not meals and accommodation

- Utilities

- Bank charges

- To maintain the bank account used for rental income and expenses

- Interest expense to finance the property

If you operate a short-term rental property that exists in an area where short-term rentals are not allowed, the expenses incurred will not be allowed to reduce your rental income. You would be considered to have a non-compliant short-term rental property. If the local government where you own your property allows for short-term rentals if you meet certain conditions (i.e. business license), then your property will become a compliant short-term rental. Once it is a compliant short-term rental, you will be able to claim the above expenses as a deduction from your rental income.

Example:

| Old Rules | New Rules – Compliant Short-term Rental | New Rules – Non-Compliant Short-term Rental | |

| Rental income | 20,000 | 20,000 | 20,000 |

| Mortgage interest | (4,000) | NIL | (4,000) |

| Property taxes | (2,000) | NIL | (2,000) |

| Utilities | (1,500) | NIL | (1,500) |

| Net Rental income for Tax Purposes | 12,500 | 20,000 | 12,500 |

So you will pay tax on $20,000 of net rental income if you are non-compliant, compared to only paying tax on $12,500 of net rental income if you are compliant.

Changes to how Rental Properties will be Taxed Read More »

2024 Federal Budget: Changes to how Capital Gains are taxed in Canada

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your tax advisor to discuss specifics to your situation and for fact appropriate advice.

NOTE: This post assumes that the Tax Measures announced in the April 2024 budget will be passed as presented. If any changes occur, we will update this article.

The 2024 Federal Budget was announced in April, which is already a busy time for accountants, so you can imagine how pleased the tax community was to find out that this particular Budget was going to make some major changes to how Capital Gains are being taxed in Canada.

In summary, as of June 25, 2024, if you are a corporation, 66.67% of a Capital Gain will be taxed in Canada. If you are an individual, you get a bit of a reprieve. The first $250,000 of capital gains, will have an income inclusion of the historical 50% rate, but any capital gains above this $250,000 amount will be included in income at 66.67%.

If you have a holding corporation that has a larger portfolio of investments, it is a good idea to meet with your financial advisor and accountant to discuss how to manage your company’s tax liability for 2024. It may be a good idea to trigger losses. But just make sure you don’t inadvertently create superficial losses that can’t be used in the current year.

For individuals, and the average Canadian, the likelihood of earning more than $250,000 in Capital Gains in a single year is on the lower end. However, if you have a rental property that you are selling or potentially, an investment in a private company was sold, you should be aware of these rules and you should reach out to your accountant for support on what this means.

If you have capital losses that were realized before June 25, 2024, those losses will still be available to offset capital gains realized at the 66.67% inclusion rate.

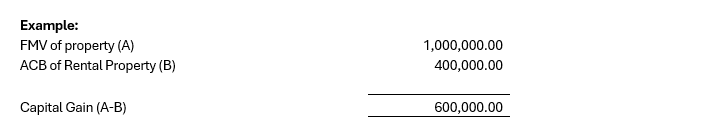

Example: Sara owns a rental property in Kelowna, BC and is a resident of BC. Due to the Federal Underused Housing Tax, and the BC Speculation and Vacancy Tax filing requirements, she’s decided that she no longer wants to own this property. She lists the property in April 2024. If she is able to sell and close on the sale before June 25, 2024, her taxes will be significantly different compared to if she sold their rental property after June 25, 2024.

She purchased the property in March 2021 for $400,000 and the current market value of the property is $1,000,000. We’ll perform our analysis as if she sold the property at its current market value.

You’ll see that Sara’s tax liability would have increased by 22% had she waited to dispose of the property until after June 25, 2024.

Affirm LLP and Affirm Wealth Ltd. are now proud and independent members of the Integrated Advisory Network and would happily meet with you if you would discuss your current situation and how to minimize the tax impact this year.

2024 Federal Budget: Changes to how Capital Gains are taxed in Canada Read More »

Short-term to Long-term Residential Rental Accommodations – GST/HST Implications

When the Federal government delivered their 2023 Fall Economic statement, they proposal that certain deductions on short-term residential rentals would no longer be allowed. This is one way that the Federal Government is trying to create more housing for people living in Canada. The belief is that the short-term rental market is impacting the number of longer term rental units that are available and affordable for people living and working in Canada. In addition, we are seeing provincial and municipal proposals to levy hefty fines to try to encourage the conversion from short term rentals to long term rentals. As a result, we’ve noted that some of our clients are wanting to switch from short-term rentals to long-term rentals.

However, there are some significant implications from a GST/HST perspective. Unfortunately, GST/HST does get overlooked, since it isn’t an area of taxation that many of us deal with on a day to day basis. This is where it pays to be curious about potential consequences.

For short-term rentals, any income earned on short-term rentals are subject to GST/HST as it’s considered a commercial activity. This means that when you rent your property on a short-term basis, you are required to collect GST/HST on these stays. Those individuals that are utilizing platforms like Airbnb and VRBO to manage their rental properties, the GST/HST is usuallybeing collected and remitted on behalf of the property owners. (This assumes that the Taxpayer has exceeded the $30,000 small supplier threshold or has registered for GST voluntarily)

When you have a long-term residential rental unit, the income earned is exempt from GST/HST. “Long-term” is anything where the stay is more than 60 continuous days. You would think that this is a positive change. One less tax filing that you will have to do in the future. However, in switching from a short-term rental to a long-term rental arrangement, or any change in use greater than 10%, you have changed the nature of the property. Since you are no longer collecting GST/HST, due to the change in the type of income you are earning, you have changed the use of the property. And as a result, you have to “dispose” of the short-term rental property and then “acquire” the long-term rental property. At the time of the change in use, you are required to pay GST/HST on the Basic Tax Content of the property to the CRA. This also applies to long-term rental properties that become short-term rental properties. At the point in time that it is no longer a long-term rental property, GST/HST on the Basic Tax Content of the property needs to be remitted to the CRA.

There was a recent court case that confirmed the application of assessing 5% GST on the property when it changes use from a short-term residential property to a long-term residential property (1351231 Ontario Inc. and His Majesty the King, 2020-2180(GST)G). In this case, the taxpayer had a condo unit that was a long-term rental and then became a short-term rental and the taxpayer did not remit the GST/HST at the time of the change in use. The court ruled in favour of the Government and therefore, the taxpayer needed to pay the GST/HST plus interest and penalties.

NOTE: This is applicable to Residential Rental units. Commercial Rental Units have a different treatment for GST/HST.

Short-term to Long-term Residential Rental Accommodations – GST/HST Implications Read More »

What to expect during a CRA Tax Audit

The dreaded Canada Revenue Agency audit. Everyone, including us, get a bit anxious when we receive a letter from the CRA informing us that a client of ours is going to be visited by their staff to perform an audit of their financial records. But realistically, there shouldn’t be too much for us to worry about since we’ve all been through the process a number of times before.

What we’d like to be able to do in this blog post is to give you a bit guidance as to what you can expect and how the process works.

Desk Audits vs Full Audits

Generally speaking, a desk audit will look at a specific period of time and a specific issue. A common desk audit would be a payroll audit or a GST audit. The most common GST desk audit is when you file your first GST return and it’s in a refund position. The CRA will generally request for a description of your revenues and as well as the 10 largest invoices as well as the 10 largest supplier invoices that they can review to ensure that you’re calculating and remitting the GST appropriately.

A Full Audit will generally be for an entire fiscal year and can expand to include a Payroll and GST audit depending on what the income tax auditor discovers. A Full audit may involve having an Income Tax Auditor spend time in your offices. It should be noted that since the COVID-19 pandemic, there are been fewer in-person audits from the CRA.

How it starts:

You will receive a letter from the Canada Revenue Agency to let you know that you or your company has been selected to have an audit performed. Check the date of the letter. You generally are given 30 days to pull together the initial information that the auditor will require. Make sure that you notify your external accountant as soon as possible so that they can help you through this process.

The initial request will be to provide information for a particular period of time. There will be a request for tax returns as filed, the trial balance, general ledger. The time period requested, will generally be for one of the previous 4 years. The CRA has a mandate that they will not audit a period older than 4 years from the last year-end unless they discover something blatantly erroneous. Then they will look at older years.

Timing:

Any time an audit occurs, it generally isn’t a great time of year. And working with the auditor will take time away from you operating your business. However, there are times that are better than others. If it’s an exceptionally busy time for you and your business, you can request an extension of time to respond to the information request. Most auditors will appreciate that their timing may not work for you.

Tips in Working with the Auditors:

- Have the auditor explain things to you. Make sure you understand why they are asking for items and also use this time to help educate them on your business. In many instances, the auditors can help you with improving your accounting systems.

- When an auditor requests for information, make sure that they make the requests in writing. Verbal requests are common, but sometimes the auditor will request for information that they may or may not actually need for their auditing procedures. You should also respond to all requests in writing. You can respond verbally, but this should also be followed up in writing. If in the future, you need to rely or challenge something from this audit, you will need to have written support to support you claims.

- While the auditors are looking for errors, they can be useful to you and your business. If there is something that you may not have deducted from your income because you weren’t sure if it was an allowed deduction, ask them. If it is a deductible expense, they will help you adjust your return so that it reflects the additional expense.

- Don’t drag your heels when responding to their questions. If you know that it will take time to produce the information that they are looking for (i.e. need to request the information from storage; or if you are working on a larger project at work), let them know that it will take some time to get back to them.

- Just remember, that the longer that it takes to get back to them, there could be more areas that they will look at as they are waiting on your information.

Wrapping up the Audit:

Once an audit is completed, you’ll receive a letter from the auditor. It will summarize their findings and what the next steps would be. This will generally mean that the audit is finished.

If there were a number of errors found, you can expect that another CRA audit will likely happen in the near future. If the number of errors found were minimal, you shouldn’t expect to hear from the CRA for a number of years.

If a number of errors were found in your income tax audit, you can also expect to be contacted by the Payroll Auditors and the Excise Tax Auditors (GST/HST).

What to expect during a CRA Tax Audit Read More »

Benefits and Disadvantages of a Joint Spousal and Alter Ego Trust

Note: This blog post is information that is directed towards those individuals who have assets in BC and Ontario, but may be of interest to others as well.

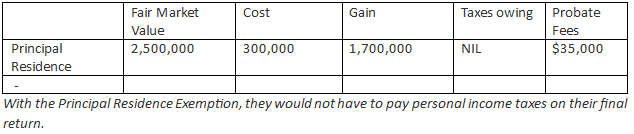

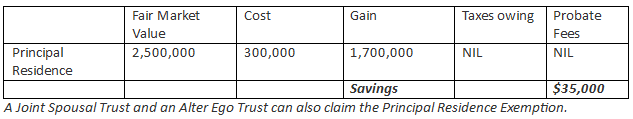

If you are over 65 years of age, an Alter Ego Trust or a Joint Spousal Trust can be used to assist with your Estate Tax Plans and to help minimize the taxes due on your death as well as assisting in avoiding Probate Fees. Probate fees in BC are 1.4% of the Fair Market Value of the assets in a person’s estate. But like anything, there are advantages and disadvantages of creating one of these trusts.

Advantages:

These trusts can save your estate money when you die.

Asset Held Personally

Assets held in a Trust

Total cash savings when assets are in the trust is $35,000.

Ideally, we feel that this is a good option if your principal residence is worth more than $2.5 Million dollars. The savings on probate fees will outweigh the administration costs of maintaining the trust year to year.

There are other assets that could also be put into these trusts, but we would need to review this on an asset by asset basis.

These trusts will also allow you to live as you normally would. You can stay in your home and you still receive income from the assets that are placed in these trusts.

Some additional non-financial reasons why you might consider using a joint spousal trust or an alter ego trust in your estate planning is for privacy or in the instances of blended families. Assets in these trusts are not subject to public probate records nor can they be contested by beneficiaries. These trusts are also useful where there are adult children and the parent remarries and wants to ensure the new spouse can enjoy use of the family home and other assets until the spouse’s passing, after the spouses’ passing the assets can be distributed to children.

Disadvantages:

The biggest disadvantage of creating these trusts are the tax rates that these trusts pay on the undistributed income earned during a tax year. Trust income is taxed at the highest marginal tax rate for individuals, based on where the trust is located. In Alberta the top marginal tax rate is 48.%; in BC, it is 53.50%; and in Ontario, it is 53.53%.

The trusts can usually avoid paying tax at these rates by distributing their income out to the beneficiaries of the trust during the year.

An additional disadvantage is the cost to maintain the trust every year, by filing additional tax returns and paying any trustee or other administration fees. The trust is effectively a separate legal entity that must be maintained separate from your personal affairs.

The last disadvantage that we wanted to mention in this blog, is the differences that occurs when you die and your assets have been held personally, compared to when you die and your assets are held in a Trust.

When you die with a regular will, there is a deemed disposition of all your financial assets at their fair market values on that date. The gains and losses on these assets are realized on your final personal tax return and are automatically acquired by your Estate at those fair market values. The Estate is then administered by your executor/executrix as outlined in your will. From a tax perspective, your Estate is eligible to be treated as a Graduated Rate Estate and is taxed as an individual would be however, without the benefit of any personal tax credits. This means that the estate would be taxed on the same graduated tax rate schedule as an individual. This only lasts for 3 years and after the first 36 months, the tax rate defaults to the highest marginal rates.

Conversely, if you die and your assets are in a Joint Spousal Trust or an Alter Ego Trust, the assets in these Trusts are not eligible for these same graduated rates. Upon death, the assets in the Joint Spousal Trust or Alter Ego Trust will be taxed at the highest marginal tax rate; the assets will then be distributed from this Trust in accordance with the instructions in the trust indenture. The Joint Spousal Trust and Alter Ego Trust assets are held separate from the estate so the Trust assets will bypass any application of the last will and testament of these assets. It is therefore very important that the Trust Indenture and the Last Will and Testament be updated at the same time to ensure there is no conflict between these two very important legal documents.

This is a very simplified summary of some of the advantages and disadvantages that a Trust can provide to taxpayers and our belief is that, while there are some disadvantages to having a Joint Spousal Trust or an Alter Ego Trust, the cash tax savings should not be ignored. And many of the potential disadvantages just need to be analyzed to ensure that the cash tax savings still exists. If this is something that is of interest to you, please feel free to reach out to us to discuss further.

Benefits and Disadvantages of a Joint Spousal and Alter Ego Trust Read More »

Ch-Ch-Ch-Changes: Short Term Rentals, Bare Trusts and the Underused Housing Tax

Well, we’ve just received the Fall Economic Statement from our Government. In there, were a bunch of tidbits. And one change that was found on the CRA website that could be helpful to some taxpayers.

Short-Term Rentals

There is one in particular that I think was highly unfortunate to see. Mortgage interest is no longer an eligible expense if you use your home for short-term rentals.

Part of the 2023 Fall Economic Statement addressed the housing crisis that many Canadians are seeing with a lack of affordable housing. To combat this, the government is cracking down on short term rentals. Where short term rentals are prohibited, or where licensing/permits/registration requirements are required but where the taxpayer has not obtained appropriate licensing, the federal government intends to deny tax deductions incurred to earn short term rental income. This change is proposed for periods from Jan 1, 2024 onwards. As an example, if you own a short term rental and previously collected $100,000 of rental income, and had mortgage interest of $80,000, only $20,000 may be taxable. In 2024, if the short term rental falls subject to these rules, the entire $100,000 collected would be taxable. This could result in significant tax liability for the taxpayer.

Bare Trusts

I know that we discussed this in a previous blog post (see “You May now have a Trust Reporting Requirement Under the New Trust Reporting Rules”), but this is one of the areas that is causing a lot of concern for us at Affirm LLP.

A Bare Trusts is an entity or individual that holds title to something for the beneficial use of someone else. They are not considered to be “regular” trusts and do not have to have a formalized trust agreement. Nor have they had to file a Trust Return. However, as a part of the Budget and then formalized in Bill C-32, there are new trust reporting requirements that make it a requirement for these types of arrangements to file a tax return.

As of this month (December 2023), the CRA has created a new FAQ type of page to help all of us work through what needs to be reported and how to report it. (https://www.canada.ca/en/revenue-agency/services/tax/trust-administrators/t3-return/new-trust-reporting-requirements-t3-filed-tax-years-ending-december-2023.html) According to the preamble on this page, it will be updated periodically, so it is expected that this is just the beginning of the information that they are going to provide to us. This is similar to how they managed the new Underused Housing Tax reporting requirements.

We can’t reiterate enough that if you do feel that you are in a Bare Trust arrangement, please reach out to your tax advisor and they can help you figure out what needs to be done to keep you compliant with the CRA.

Ch-Ch-Ch-Changes: Short Term Rentals, Bare Trusts and the Underused Housing Tax Read More »