This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your tax advisor to discuss specifics to your situation and for fact appropriate advice.

NOTE: This post assumes that the Tax Measures announced in the April 2024 budget will be passed as presented. If any changes occur, we will update this article.

The 2024 Federal Budget was announced in April, which is already a busy time for accountants, so you can imagine how pleased the tax community was to find out that this particular Budget was going to make some major changes to how Capital Gains are being taxed in Canada.

In summary, as of June 25, 2024, if you are a corporation, 66.67% of a Capital Gain will be taxed in Canada. If you are an individual, you get a bit of a reprieve. The first $250,000 of capital gains, will have an income inclusion of the historical 50% rate, but any capital gains above this $250,000 amount will be included in income at 66.67%.

If you have a holding corporation that has a larger portfolio of investments, it is a good idea to meet with your financial advisor and accountant to discuss how to manage your company’s tax liability for 2024. It may be a good idea to trigger losses. But just make sure you don’t inadvertently create superficial losses that can’t be used in the current year.

For individuals, and the average Canadian, the likelihood of earning more than $250,000 in Capital Gains in a single year is on the lower end. However, if you have a rental property that you are selling or potentially, an investment in a private company was sold, you should be aware of these rules and you should reach out to your accountant for support on what this means.

If you have capital losses that were realized before June 25, 2024, those losses will still be available to offset capital gains realized at the 66.67% inclusion rate.

Example: Sara owns a rental property in Kelowna, BC and is a resident of BC. Due to the Federal Underused Housing Tax, and the BC Speculation and Vacancy Tax filing requirements, she’s decided that she no longer wants to own this property. She lists the property in April 2024. If she is able to sell and close on the sale before June 25, 2024, her taxes will be significantly different compared to if she sold their rental property after June 25, 2024.

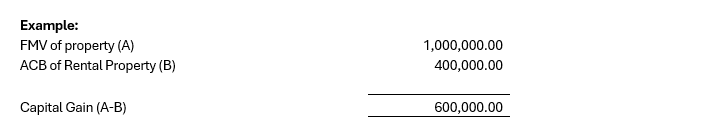

She purchased the property in March 2021 for $400,000 and the current market value of the property is $1,000,000. We’ll perform our analysis as if she sold the property at its current market value.

You’ll see that Sara’s tax liability would have increased by 22% had she waited to dispose of the property until after June 25, 2024.

Affirm LLP and Affirm Wealth Ltd. are now proud and independent members of the Integrated Advisory Network and would happily meet with you if you would discuss your current situation and how to minimize the tax impact this year.